Step-by-Step Guide for Xero PSG Claim

We are leading cloud integrator having offices in Singapore and Malaysia assisting businesses to implement new software or integrate different software solutions into single workflow. If you are thinking of consolidating business processes by using modern software or hardware solutions, we would love to chat with you more.

Step-by-Step Guide for PSG Claim via the Business Grants Portal

You may follow the step-by-step guide below to claim your subsidy from the Productivity Solutions Grant for your digital solutions.

If you have questions on the application process, please contact your consultant. Alternatively, you may contact us via 6515 7906 or enquiry@361dc.com.”or enquiry@361dc.com.

Getting Ready

- Your company’s UEN, CorpPass ID and password for login to the Business Grants Portal

- Website www.businessgrants.gov.sg

- Signed acceptance of vendor quotation for Xero

- Invoice

- Receipt

- Bank statement showing payment

- Picture eg. license number(s) of software

- Usage report of at least one month

- Other documents eg. vendor’s clarification letter

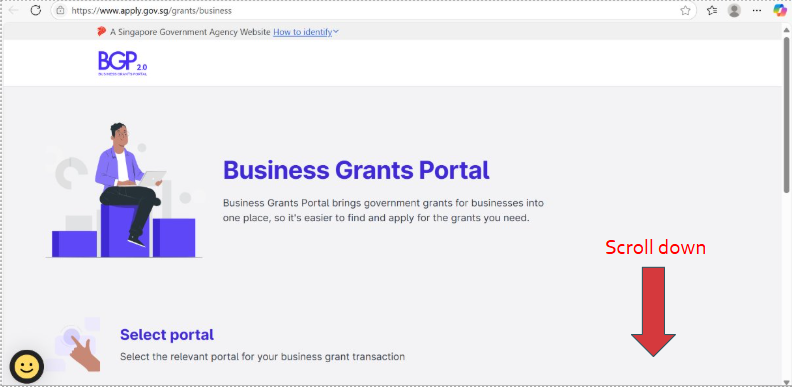

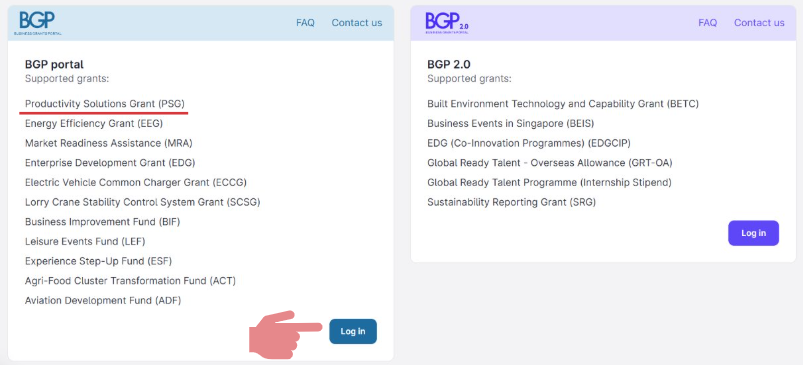

Select your Portal & Login with Corppass

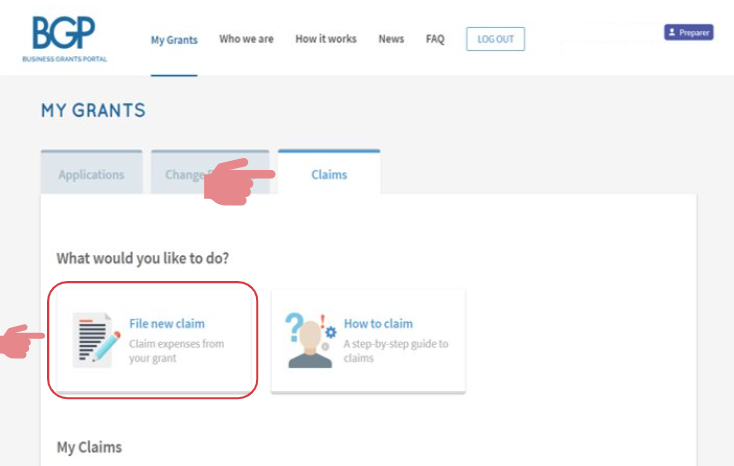

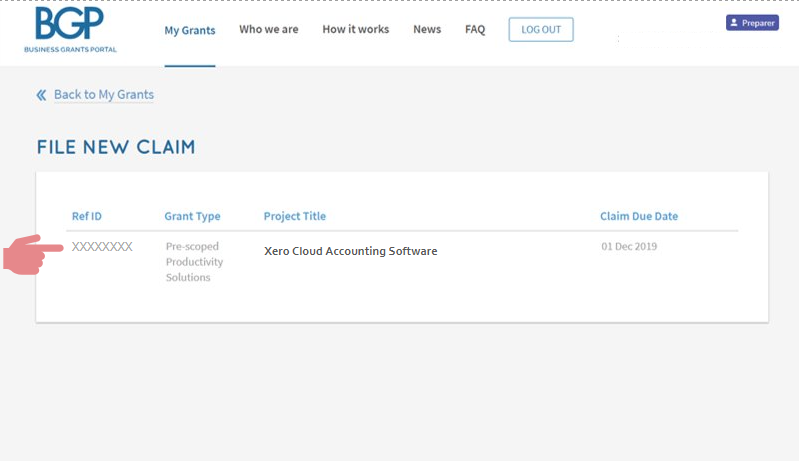

Click on "Claims" tab & Click on "File new claim"

Click on the project to be claimed

Disclaimer: Image below is only an example

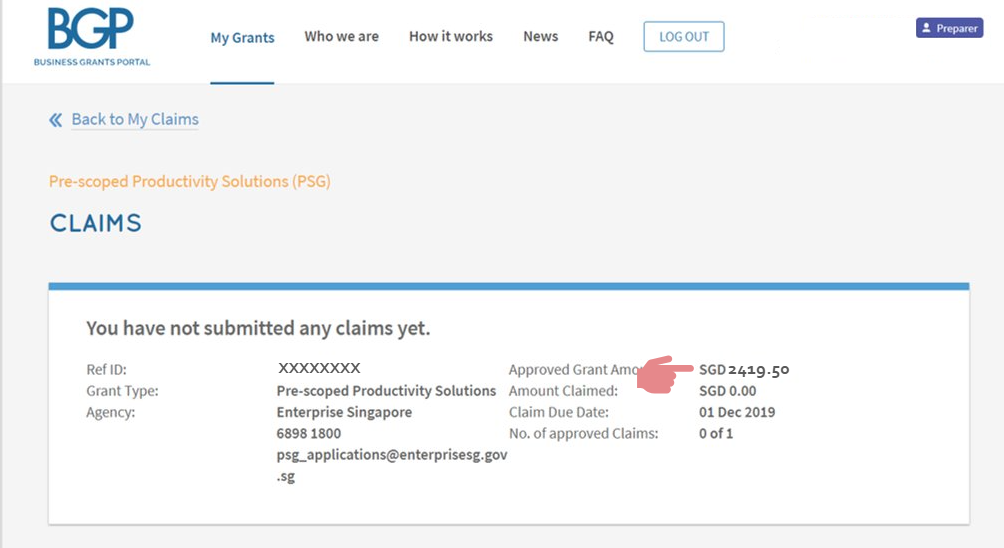

Check that the approved grant amount is correct

Disclaimer: Image below is only an example

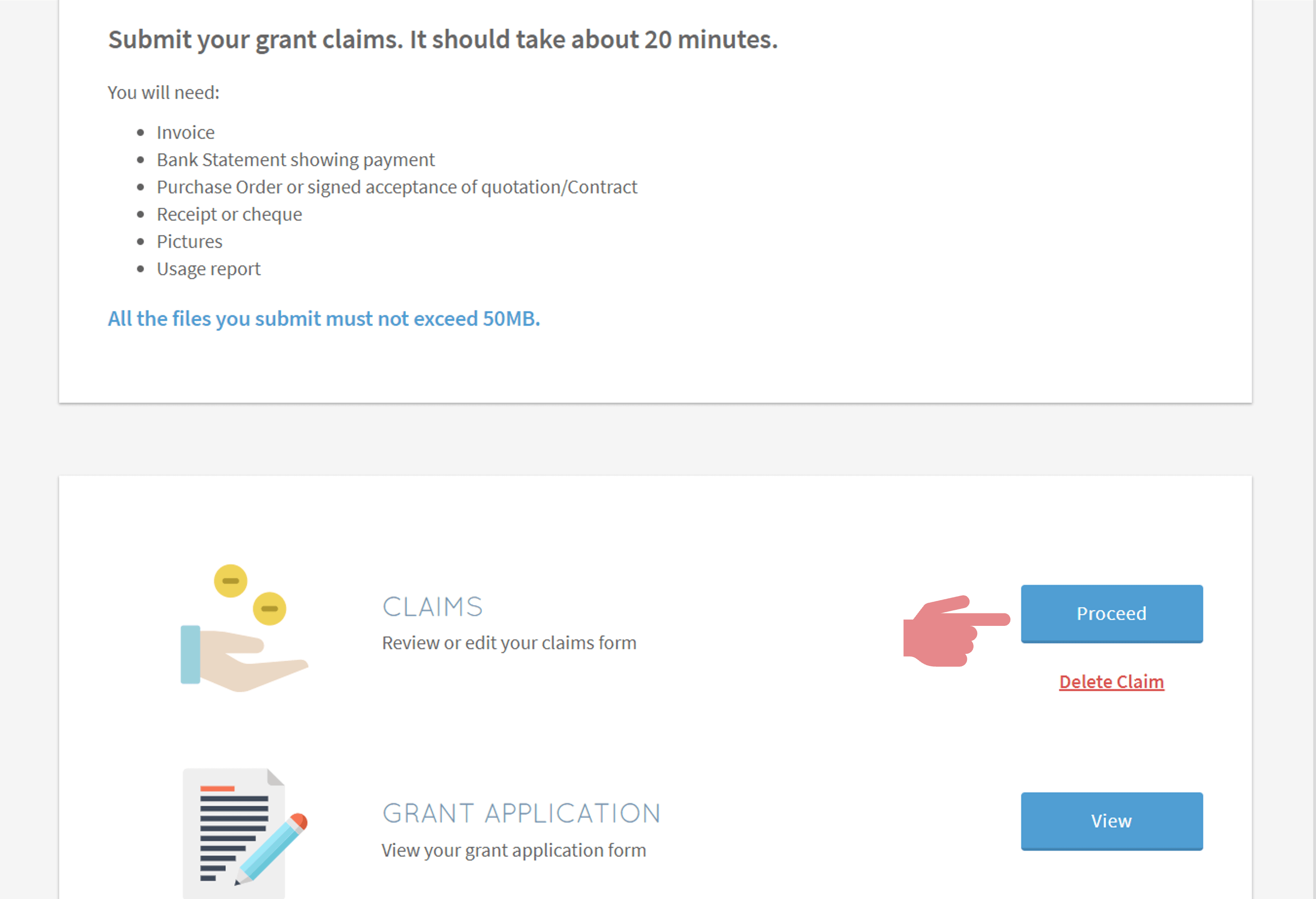

Click on "Proceed"

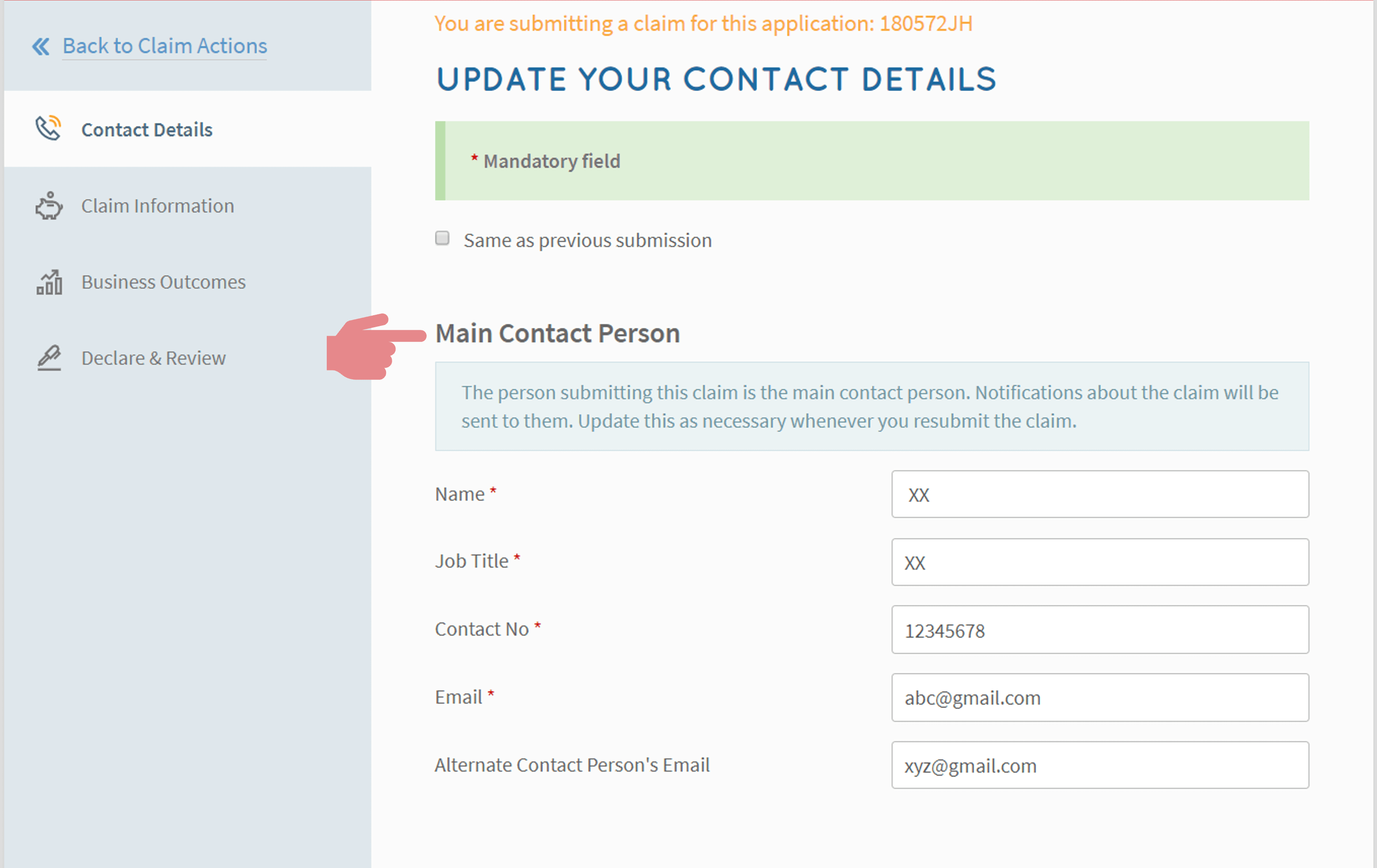

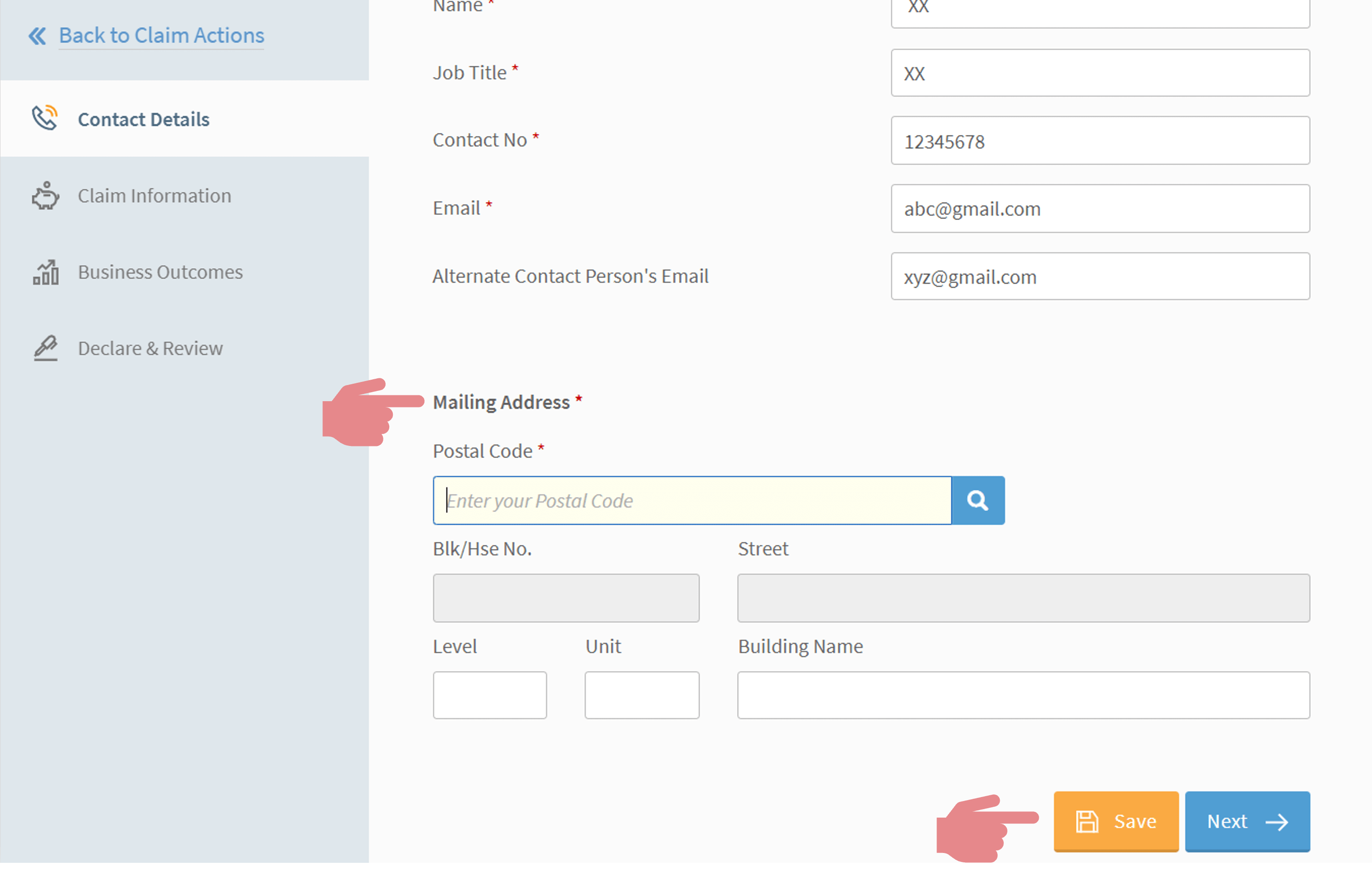

Provide the relevant contact details

Provide the mailing address & Click on "Next"

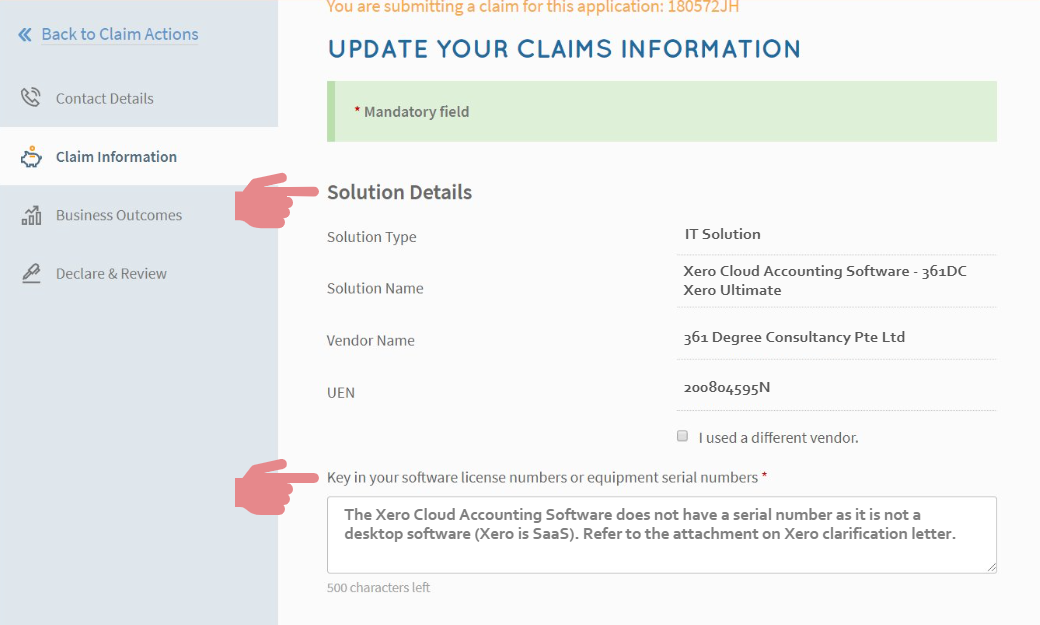

Check that the solution details are correct & Refer to the text box

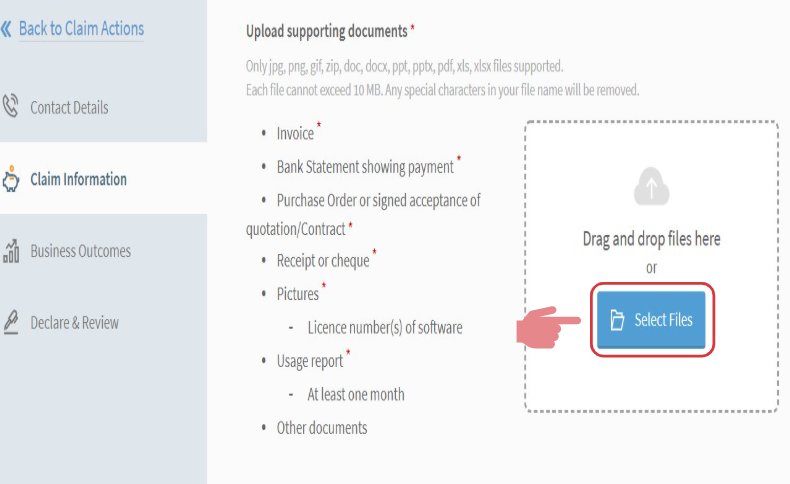

"Attach" all supporting documents and "tag" accordingly

Note: Attachments should not exceed 50MB

You may contact your consultant for the supporting documents

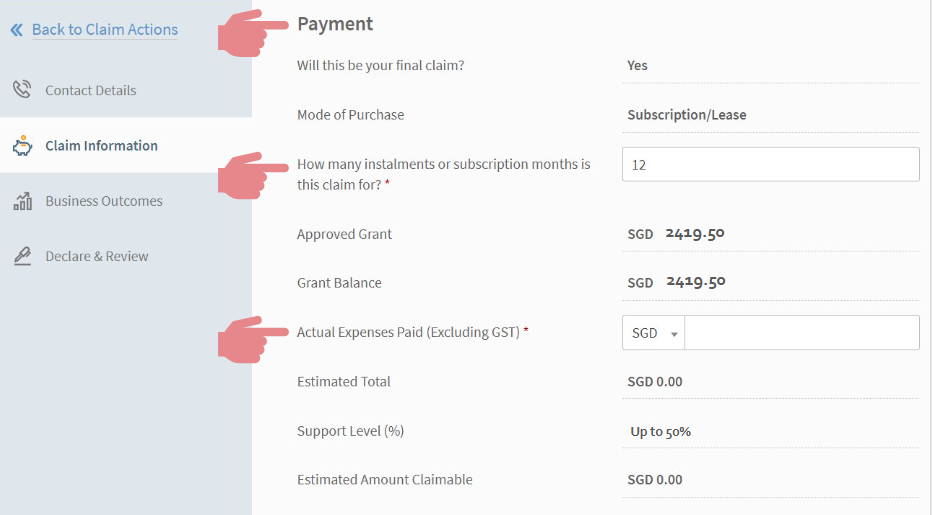

Check through the payment details & Key in the total amount paid to vendor (excluding GST)

Portal will auto-populate “Approved Grant” “Grant Balance” “Estimated Total” and “Estimated Amount Claimable”

Disclaimer: Image below is only an example

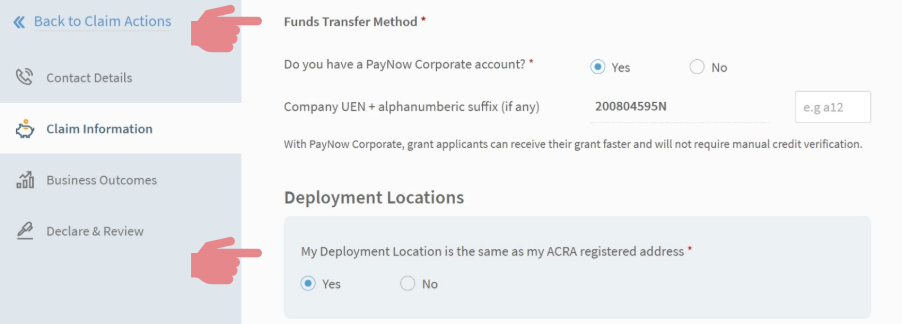

Funds Transfer Method

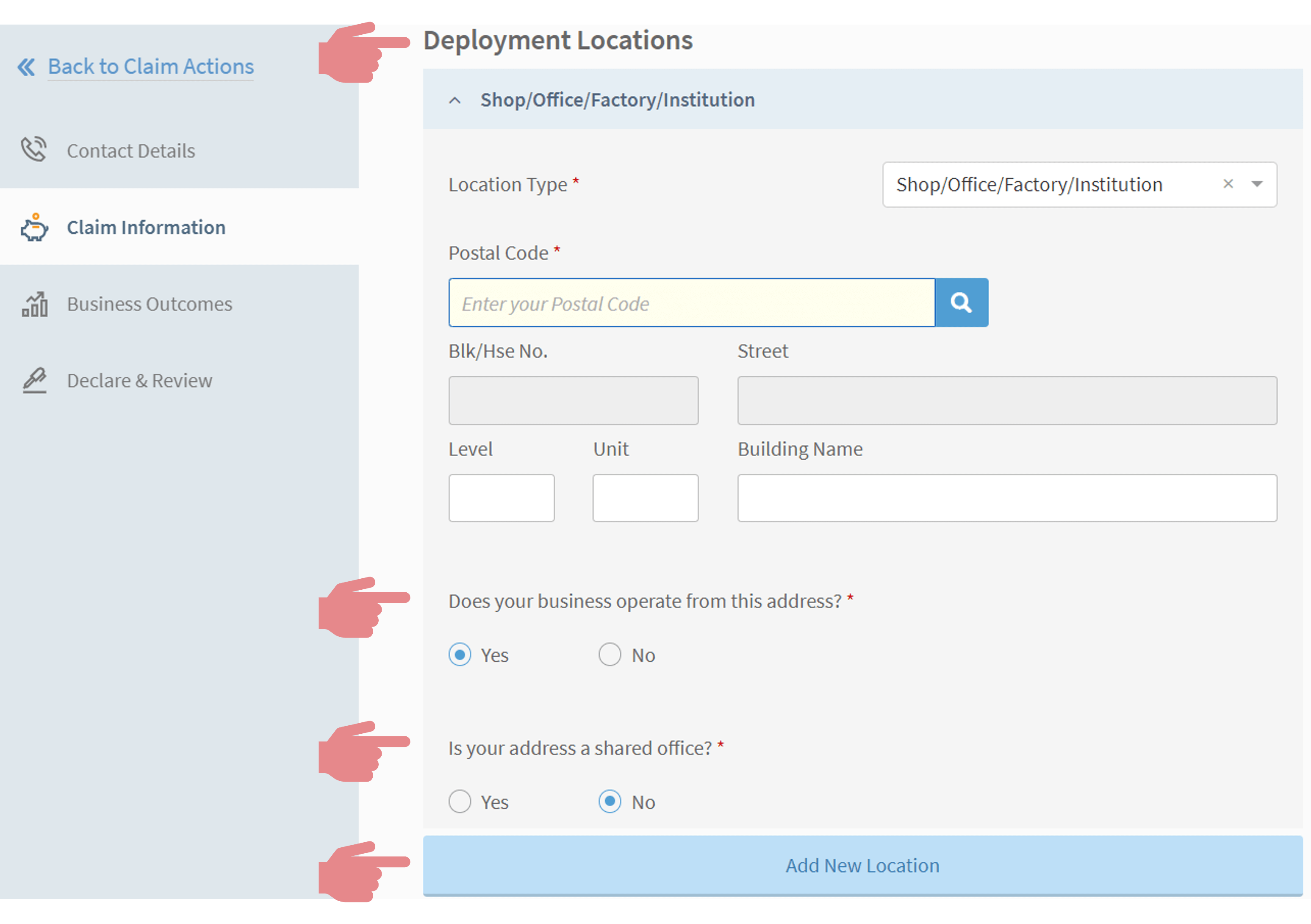

Insert deployment location, only if different from ACRA registered address

Click on "Next" to proceed

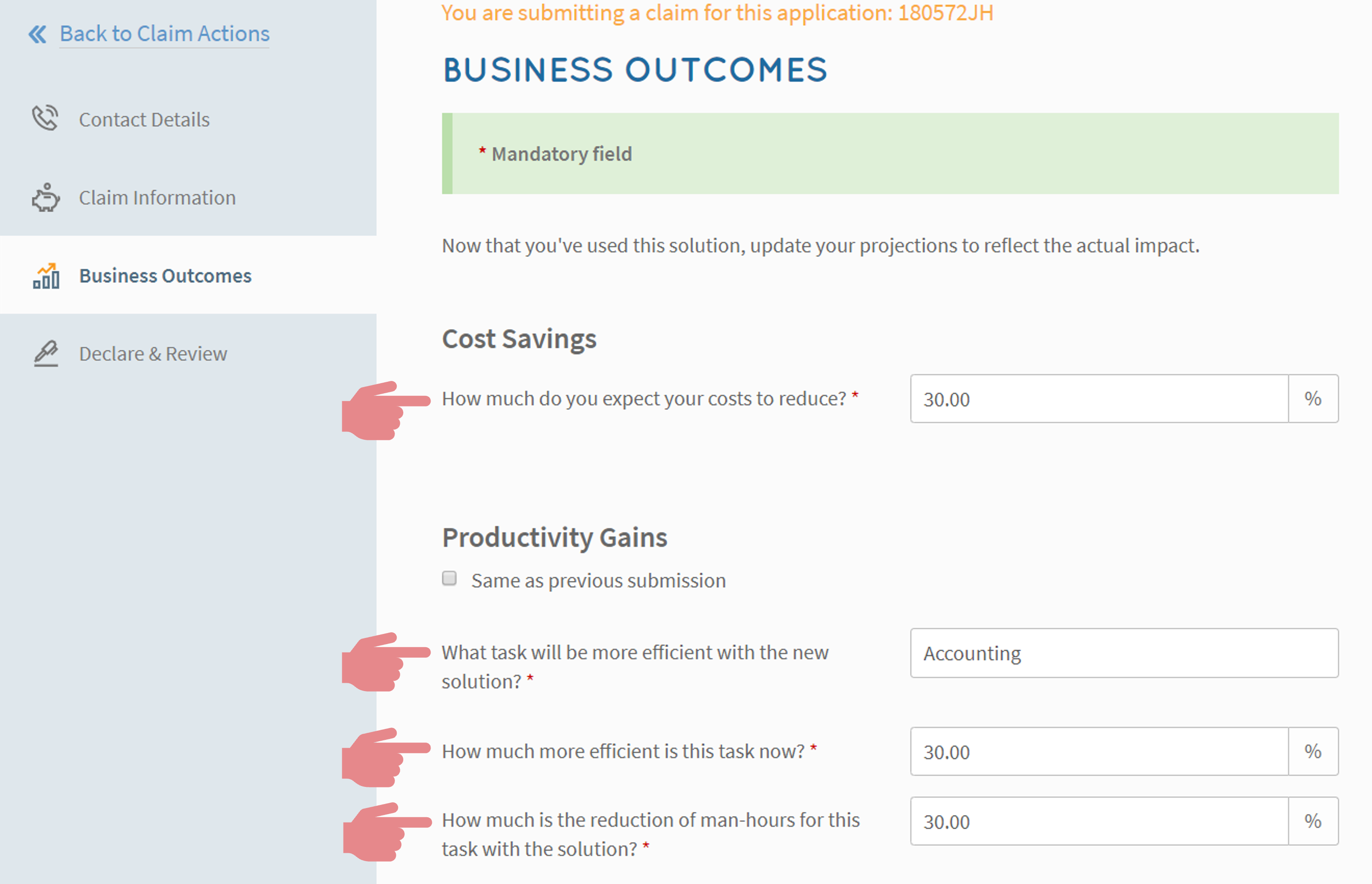

Input the business outcomes as shown

Insert feedback (if any) & Click on "Next"

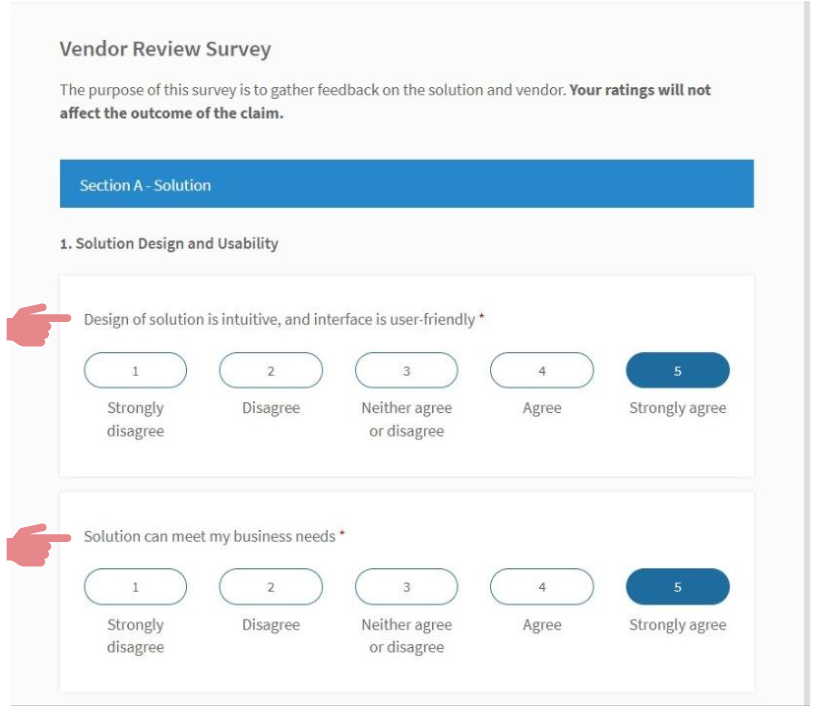

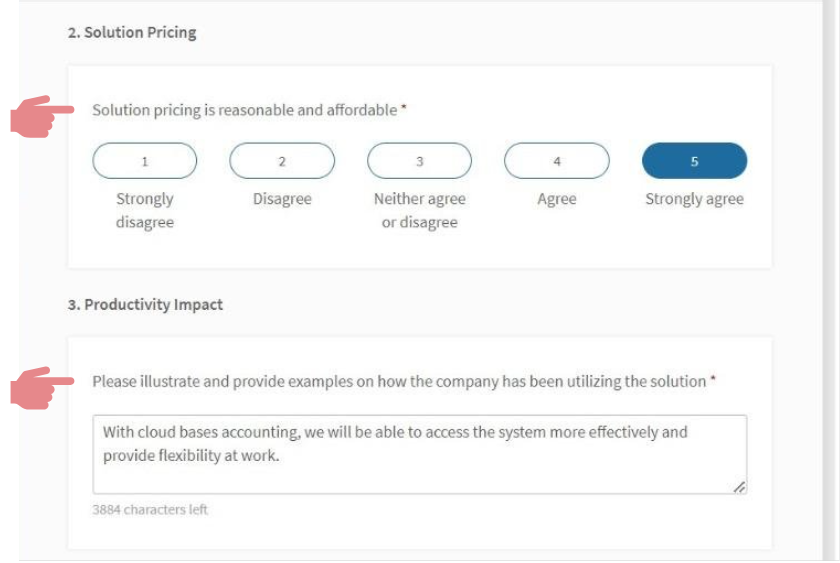

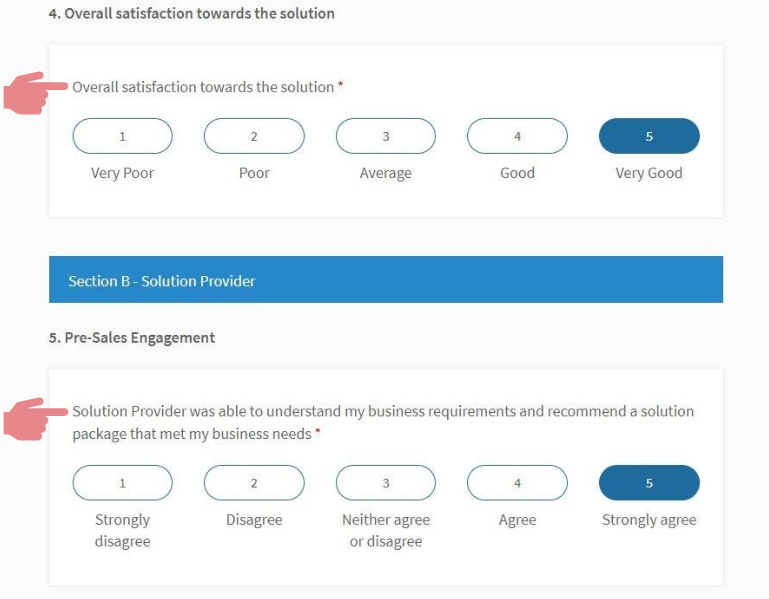

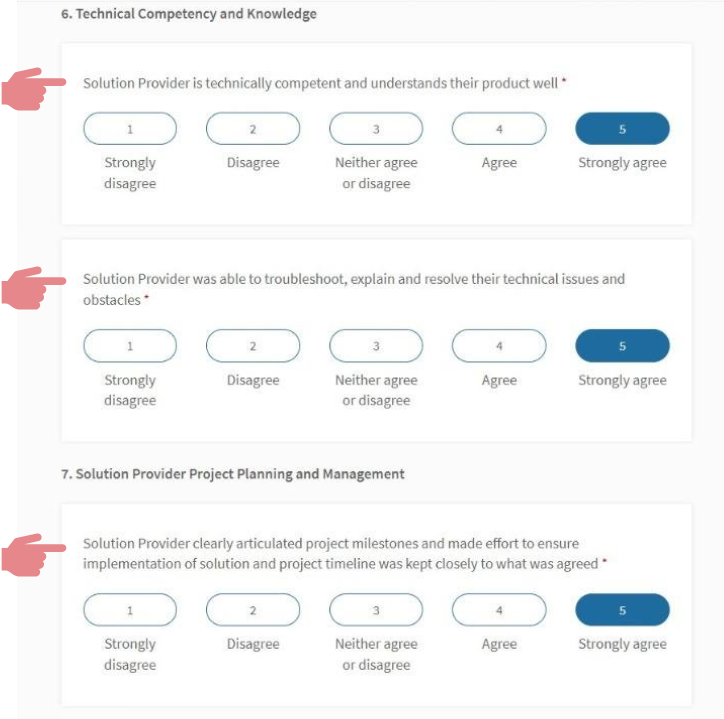

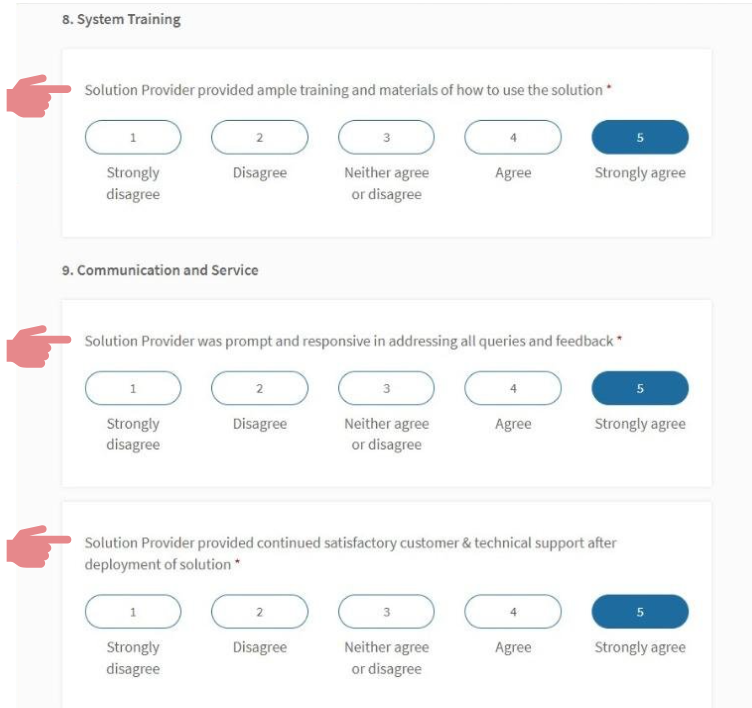

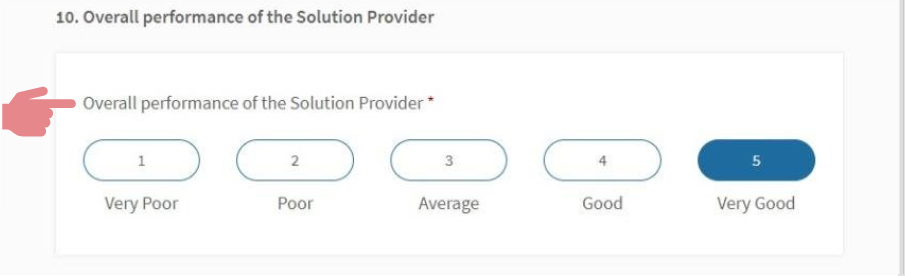

Complete the vendor review survey (Part 1)

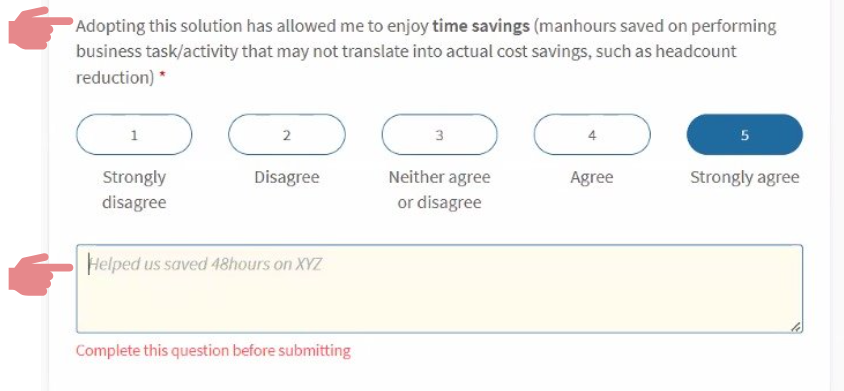

Complete the vendor review survey (Part 2)

Complete the vendor review survey (Part 3)

Suggested answers:

1. Xero’s automated bank reconciliation matches transactions with invoices, which has helped me to save 2-3 hours per week.

2. Xero’s automatic invoicing and payment reminders mean I no longer have to chase overdue payments, helping me save 1-2 hours per week.

3. Xero’s mobile app allows me to easily snap and upload receipts, speeding up my expense tracking and saving 30 minutes to 1 hour per week.

4. Saved 1-2 hours per month: Xero generates financial reports with just a few clicks, which saves me from doing manual calculations and managing spreadsheets.

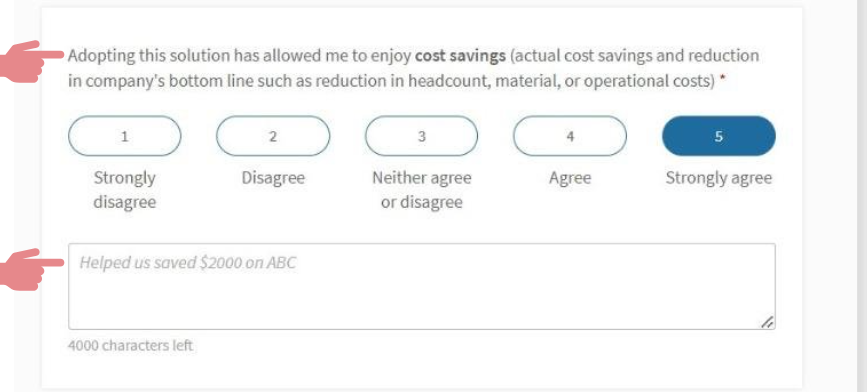

Complete the vendor review survey (Part 4)

Suggested answers:

1. Automation of Accounting Tasks: Xero automates invoicing and reconciliation, reducing the need for manual work and saving on labor costs.

2. Real-Time Financial Insights: Xero provides instant access to financial data, helping you avoid costly mistakes and make more informed decisions that save money.

3. Cloud-Based Access: Xero’s cloud-based system eliminates the need for expensive hardware, IT infrastructure, and maintenance costs.

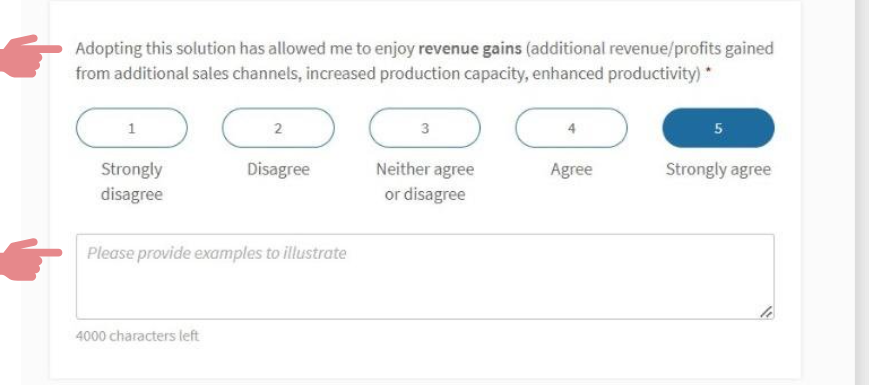

Complete the vendor review survey (Part 5)

Suggested answers:

1. Xero has helped streamline my invoicing process, ensuring faster payments and reducing delays, which has directly contributed to improved cash flow and revenue gains.

2. With Xero’s real-time financial insights, I can quickly identify profitable areas of my business and make informed decisions, leading to increased revenue.

3. Xero’s easy integration with payment gateways has made it easier for customers to pay quickly, which has led to an increase in timely payments and overall revenue.

Complete the vendor review survey (Part 6)

Complete the vendor review survey (Part 7)

Complete the vendor review survey (Part 8)

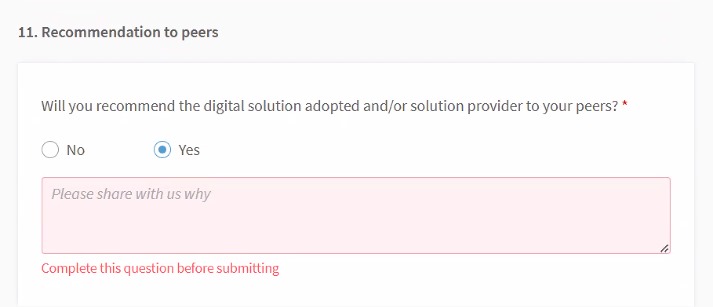

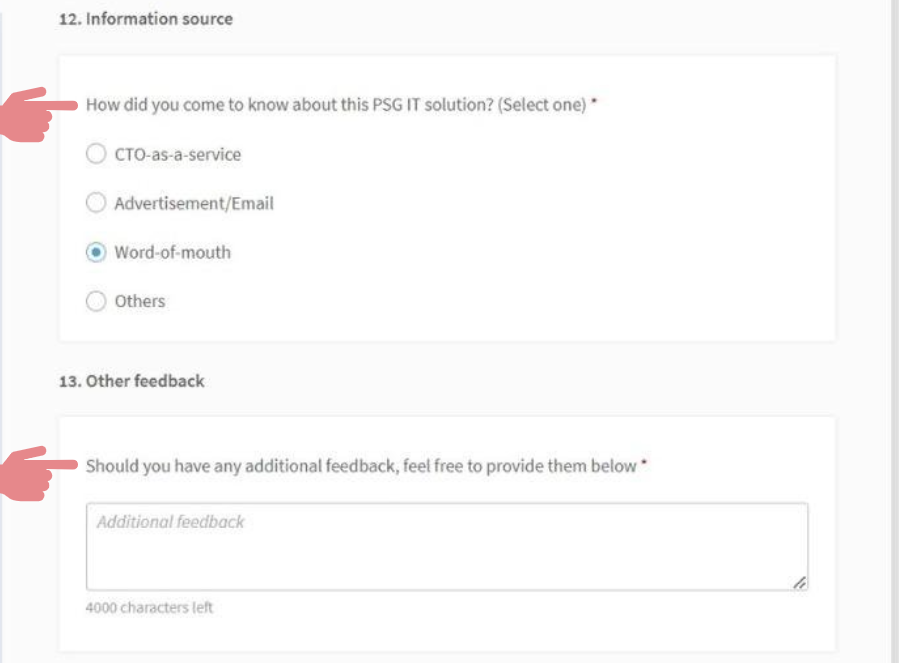

Complete the vendor review survey (Part 9)

Complete the vendor review survey (Part 10)

Suggested answers:

1. Yes, Xero is an efficient tool that saves time and streamlines accounting.

2. Definitely, it simplifies financial management and reduces the need for manual work.

3. Absolutely, Xero makes bookkeeping easy and integrates well with other tools.

4. For sure, it offers great value with its automation and user-friendly interface.

Complete the vendor review survey (Part 11)

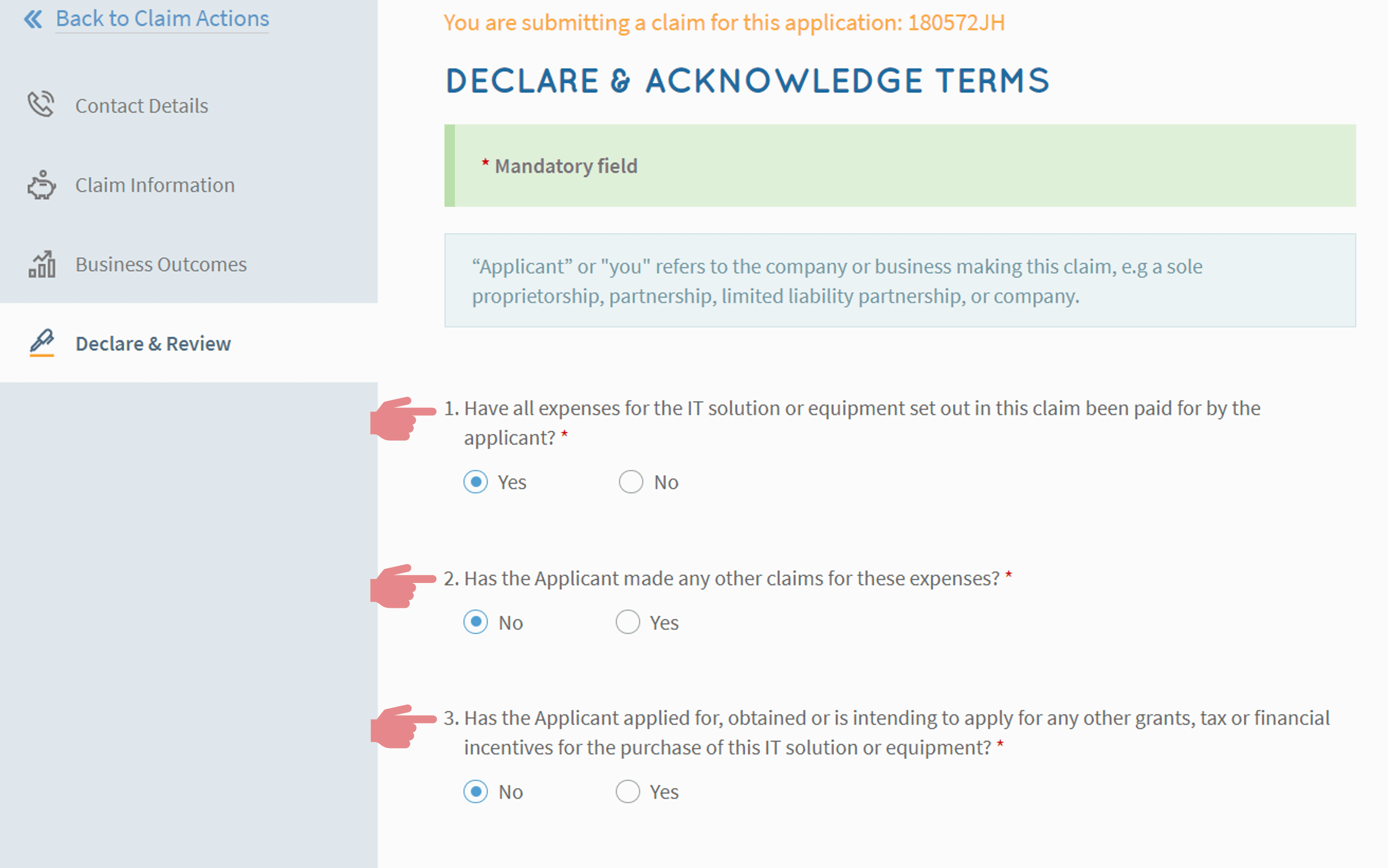

Declaration (part 1)

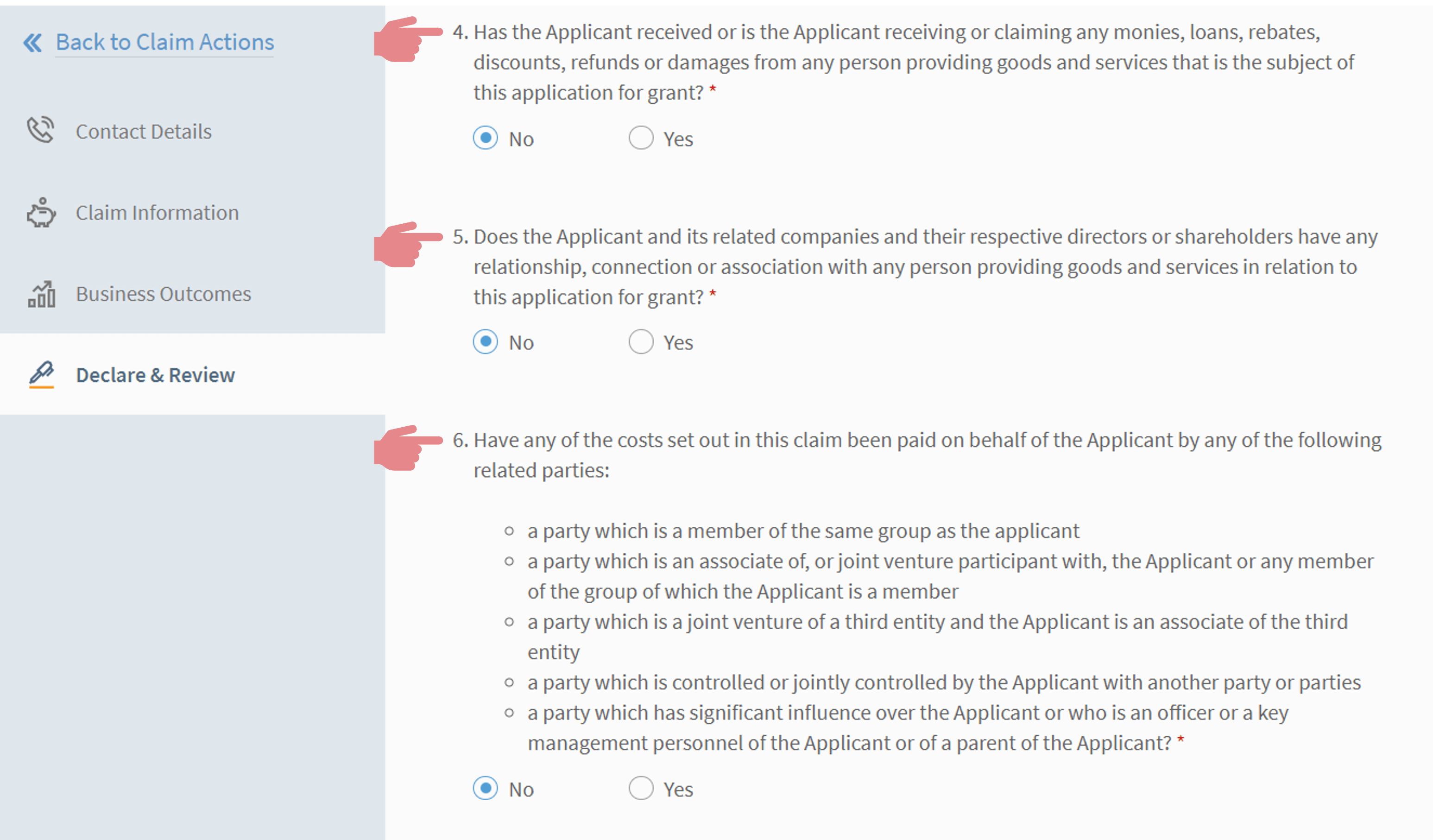

Declaration (part 2)

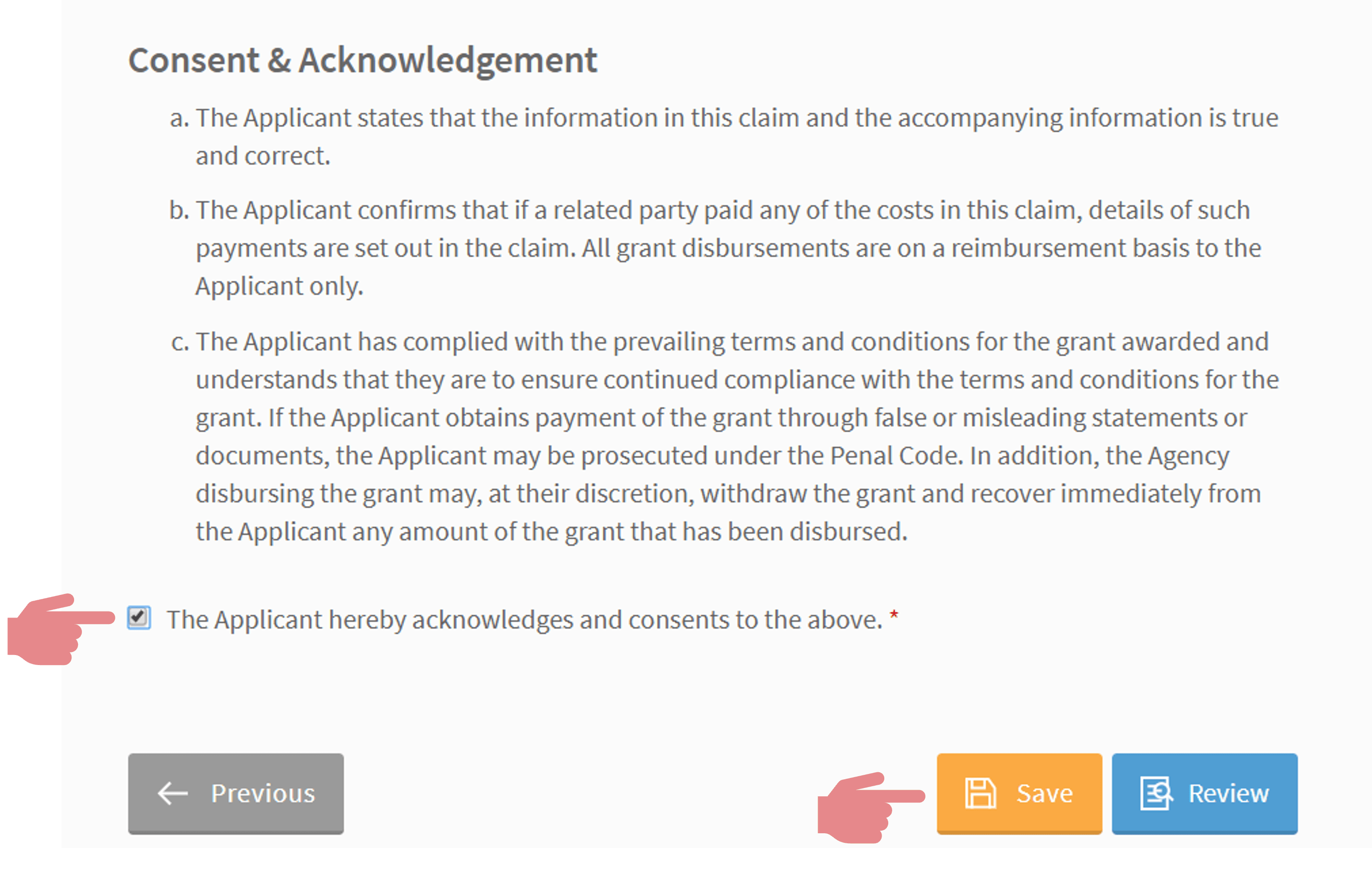

Check box for consent and acknowledgement

Click on "Review" & "Submit" claim after reviewing