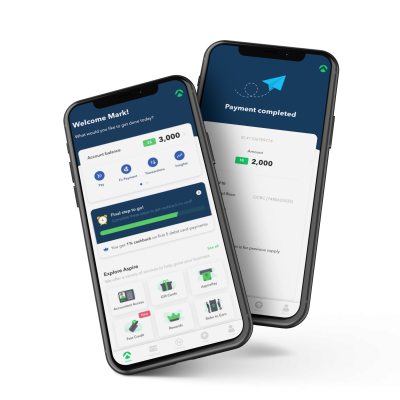

It is a virtual business account that functions similarly as with any other usual corporate current accounts but without a cheque book & physical locations. An Aspire Business Account allows companies to manage their financial transactions quickly and conveniently all within one single setting.

Registration for the Aspire Business Account is simple and free. All it takes is just 5 to 10 minutes to sign-up, and approvals should take up to 24-48 hours! To top it off, you will also have easy access to apply for an Aspire Credit Line that may provide you with an affordable working capital financing solution to help grow and expand your business.