Are you an employer in Singapore looking to support your lower-wage workers while receiving government co-funding? The Progressive Wage Credit Scheme (PWCS) is here to help! Introduced in Budget 2022, the PWCS has just been enhanced in Budget 2025 to provide even greater support for employers. Let us break it down in simple terms so you can understand how it works and how your business can benefit.

What is the Progressive Wage Credit Scheme (PWCS)?

The PWCS is a government initiative designed to help employers adjust to mandatory wage increases for lower-wage workers under the Progressive Wage Model (PWM) and Local Qualifying Salary (LQS) requirements. It also encourages employers to voluntarily raise wages for their lower-wage employees.

From 2022 to 2026, the government will co-fund wage increases for eligible Singaporean and Permanent Resident employees. The best part? Employers don’t need to apply for the scheme—payouts are automatic!

What’s New in Budget 2025?

The PWCS has been enhanced to provide even more support for employers. Here’s what’s changing:

- Increased Co-Funding for 2025

a. For wage increases given in 2025, the government’s co-funding support will increase from 30% to 40%.

b. This enhanced support also applies to wage increases given in 2024 and sustained in 2025.

- Increased Co-Funding for 2026

a. For wage increases given in 2026, the government’s co-funding support will increase from 15% to 20%.

b. This enhanced support also applies to wage increases given in 2025 and sustained in 2026.

How Does the PWCS Work?

Here’s a simple breakdown of the scheme’s design:

- Eligible Employees

a. Singapore Citizens and Permanent Residents.

b. Employees must earn $4,000 or less in average gross monthly wages to qualify. - Wage Increase Requirements

a. The average gross monthly wage increase must be at least $100 in the qualifying year.

b. Wage increases are co-funded for two years. For example, a wage increase in 2024 will be supported in 2024 and again in 2025 if sustained. - Wage Ceiling

The scheme supports wage increases up to a $3,000 gross monthly wage ceiling.

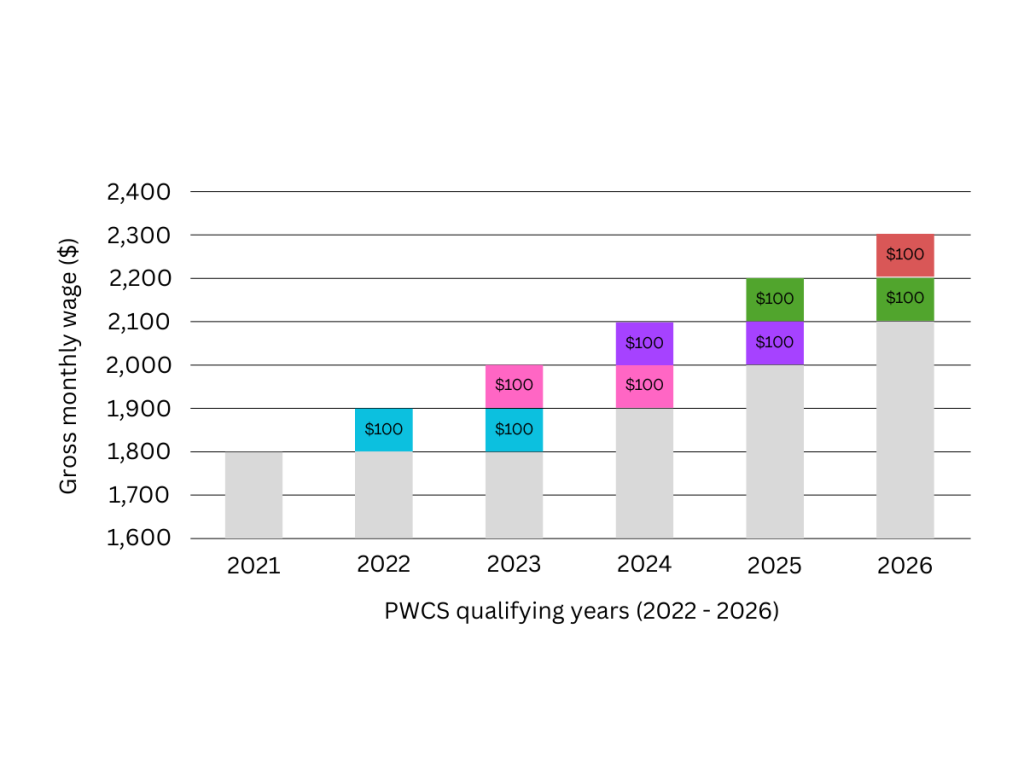

Example of PWCS

Employee who earns $1,800 per month in 2021, and experiences average gross monthly wage increase of $100 in January of each year.

| 2021 | 2022 | 2023 | 2024 | 2025 | 2026 |

Gross Monthly Wage | $1,800 | $1,900 | $2,000 | $2,100 | $2,200 | $2,300 |

First Tier (Gross monthly wage ceiling <= $2,500) | Single Tier (Gross monthly wage ceiling <= $3,000) | |||||

PWC Co-Funding Level | – | 75% | 75% | 50% | 40% | 20% |

Wage Increase Eligibile | – | $100 | $200 | $200 | $200 | $200 |

PWCS Co-Funding | – | $75 | $150 | $100 | $80 | $40 |

Second Tier (Gross monthly wage ceiling >2,500 and <=$3,000) |

|

| ||||

N.A. |

|

| ||||

PWCS Co-Funding Per Month | – | $75 | $150 | $100 | $80 | $40 |

Total PWCS Payout for the year | – | $900 | $1,800 | $1,000 | $960 | $480 |

Is Your Firm Eligible?

Your firm automatically qualifies for PWCS if:

- You give wage increases to resident employees who:

a. Received CPF contributions from your firm for at least 3 calendar months in the preceding year.

b. Have been on your payroll for at least 3 calendar months in the qualifying year.

c. Have an average gross monthly wage increase of at least $100 in the qualifying year. - Your firm is not a local government agency, foreign embassy, or international organization.

Note: Wages paid to business owners (e.g., sole proprietors, partners, or shareholder-directors) are not eligible for PWCS.

How Will You Receive the Payout?

The process is simple and hassle-free:

- No Application Needed: IRAS will automatically notify eligible employers of their PWCS payout.

- Automatic Disbursement: Payouts will be credited by Q1 of the following year.

a. If you have a GIRO account for Income Tax/GST, the payout will be credited there.

b. If not, the payout will be credited to your PayNow Corporate account.

Why Should You Take Advantage of PWCS?

- Financial Support: The government co-funds wage increases, reducing the financial burden on employers.

- Boost Employee Morale: Raising wages for lower-wage workers can improve employee satisfaction and retention.

- Automatic Payouts: No need to apply or manage complicated paperwork—IRAS handles everything.

Key Takeaways

- The PWCS is a win-win for employers and employees, providing financial support for wage increases.

- The enhanced co-funding rates for 2025 and 2026 make it even more attractive for employers.

- Ensure your firm meets the eligibility criteria to benefit from the scheme.

What’s Next?

If you’re an employer, now is the time to review your wage policies and take advantage of the enhanced PWCS. Not only will you be supporting your lower-wage workers, but you’ll also receive significant government co-funding to ease the transition.

Stay tuned to our blog for more updates, and feel free to reach out to us at 6515 7906 or via email at enquiry@361dc.com if you have any questions about how government grants can support your business!

Interested to know how your company can benefit from the budget?

Join Our Upcoming Post-Budget Sharing!

Date: 27th March 2025

Duration: 1pm to 5pm

Venue: SingPost Centre

Auditorium, 10 Eunos Road 8, Level 5, Singapore 408600

Ticket Price: $108 (Standard Admission)

Gain expert insights and network with industry experts to ensure your company thrives in the evolving economic landscape

For our valued client, you are invited to attend this event at no cost. Simply use the promo code “361money” during registration to secure your complimentary spot.

Click on the button now to register, limited seats available!

Alternatively, you can contact us at 6515 7906 or enquiry@361dc.com.

Here’s what some of the attendees said about our past post-budget event:

“The 361DC Post Budget Sharing 2024 seminar was insightful, interesting and well organised. It was one of the few seminars that had virtually no drop outs after break time. Demos and tibits provided by the speakers were very useful.”

– 姜宇Evan Jiang

“The seminar is really informative and useful to know more about the grants and budgeting process. I am really appreciative of giving the opportunity for the learning new things and hope to have more of seminar in future.”

– Htike San