Backed by Temasek Holdings’ Vertex Ventures, Validus is a catalyst of sustainable growth for small and medium enterprises (SMEs). Our smart online lending marketplace connects SMEs to accredited and institutional investors to easier and quicker financing at affordable rates. Founded in 2015, Validus is Singapore’s leading SME financing platform and is licensed by the Monetary Authority of Singapore.

EXCLUSIVE DEAL: SAVE 30% ON FIRST DISBURSEMENT FEE!*

What is Validus Financing Platform?

Validus is an online aggregator platform for SMEs to secure short term and medium term financing. Validus offers access to financing from individual and institutional Lenders. As a Peer‐to‐Business lending marketplace, Validus is using technology to minimise the cost of financial intermediation, and passing the benefits to both investors, and SMEs.

Catalyst for growth

Validus is a catalyst of sustainable growth for SMEs in Singapore. Our smart online lending marketplace connects growing businesses to accredited investors and institutions for financing.

ABSS Range of Products

MYOB Premier

MYOB AccountEdge (MAC Version)

MYOB Accounting

MYOB Payroll

Fulfilling Every Operational Need

Accentuate comes with a huge variety of business modules for your selection! Just to name some, you can have individual modules for Sales, CRM, POS, Accounting, Signing, Inventory, Manufacturing Resource Planning, Purchase, Recruitment, Appraisals, Marketing and many more!

Fully Integrated Software Modules

The strength of Accentuate lies in its fully integrated software modules. Operational information and business data are seamlessly transferred among all modules, thereby eliminating the need for manual data entry into multiple standalone software solutions.

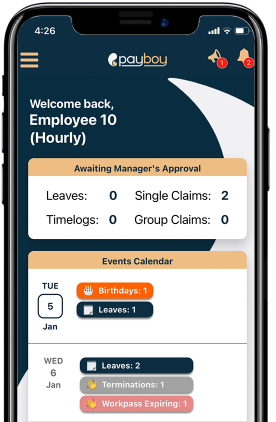

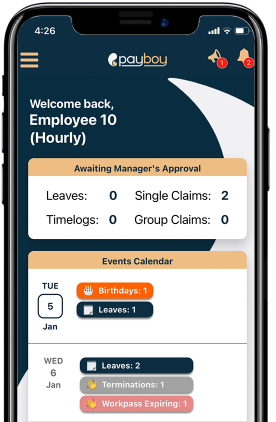

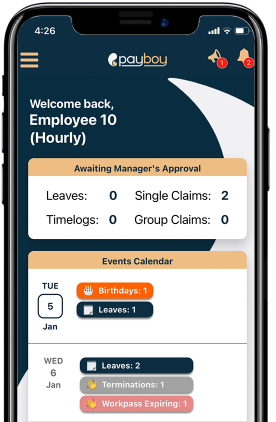

Easily accessible Payroll & HR Data

Our mobile app allows you and your employees the access to update and interact with HR related matters on the go.

Easily accessible Payroll & HR Data

Our mobile app allows you and your employees the access to update and interact with HR related matters on the go.

Easily accessible Payroll & HR Data

Our mobile app allows you and your employees the access to update and interact with HR related matters on the go.

Here are the steps on how to register and set up InvoiceNow in Xero through the integration partner, Storecove.

Features

Invoice Financing for Singapore SMEs

Here’s an affordable, cashflow-friendly solution to boost working capital – If your business offers payment terms of more than 30 days to customers, you can monetise your accounts receivable (AR)/ unpaid invoice(s) and get up to $500k. Boost your cash flow instantly using your Accounts Receivable or unpaid invoices, so you can easily fund operational expenses and overhead or expansion.

- Zero collateral required

- Easy to apply, 48-hour approval

- Up to $500,000, next-day cash

- Flexible terms – choose the invoice you want to finance

Purchase Order Financing for Small Businesses in Singapore

Need extra funds to buy inventory and complete customer orders? Boost your cash flow with a short-term purchase order financing loan to obtain additional funds at attractive, low interest rates and take your business to the next level.

- Access up to 60% of PO amount, with no collateral needed

- Fast approval outcome in 48 hours

- Personalised, low interest rates from 1.5% a month

- Simple application process, minimal documentation to apply

SME Working Capital Loan for Small Businesses in Singapore

Need to bridge that cashflow gap for capital intensive projects, invest in product development, hire more staff or simply planning to expand your business? No problem. Here’s your chance to obtain a working capital loan at attractive, low interest rates and take your business to the next level.

- Access up to $250,000, with no collateral needed

- Fast approval outcome in 48 hours

- Personalised, low interest rates from 1.5% a month

- Simple application process, minimal documentation to apply

Enterprise Financing Scheme (EFS)

Under the Enterprise Financing Scheme by Enterprise Singapore, Validus offers government-assisted SME loans so that your business can access funds to drive recovery or growth.

SME Financing Solutions (Government-Assisted Scheme)

- Trade Loan: PO Financing – Suits SMEs with large orders or contracts to kickstart projects

- Trade Loan: Invoice Financing – For SMEs issuing Invoices with credit terms of 30 – 180 days

- SME Working Capital Loan – Unsecured business loans for SMEs

Project Costing

360 Appraisal

Inventory

Why Choose Validus?

Project Costing

360 Appraisal

Inventory

Over 2 million subscribers use Xero!

Our Services

Onsite Installation

Training

MYOB Technical Support

Customization of Forms

Setting Up of Company File

Data Migration

Integrate with InvoiceNow

Integrate ABSS with InvoiceNow — a nationwide E-invoicing method that facilitates the direct transmission of invoices in a structured digital format across finance systems. Operating on the open standard Peppol network, this new standard of invoicing will help both Small and Medium Enterprises (SMEs) and Large Enterprises (LEs) enjoy smoother Invoicing, faster payments and a better way to save the environment.

ABSS PSG Application and Claim process guides

ABSS PSG Application and Claim process guides

Enjoy FREE K-Reporting (Worth US$199/month) when you subscribe Xero through us!

K-Reporting is an automated financial reporting tool that provides you with customizable reports and visualization.

Why choose Team 361 as your Xero vendor?

Xero PSG Application and Claim process guides

Here are the steps on how to register and set up InvoiceNow in Xero through the integration partner, Storecove.

Training is provided to ensure that you fully utilize the powerful capabilities of Xero

Learn what we cover in our training sessions here

Validus Financing Platform: Frequently Asked Questions (FAQ)

Validus transacts in Singapore Dollars.

Validus does not hold a banking licence and does not operate as a bank. We seek to provide support to SMEs not financed by the banks or financial institutions, as well as SMEs needing top-ups for growth related funding.

Validus offers the opportunity for investors to earn a higher rate of interest against diversified risks. We aim to create a strong social impact in a safe jurisdiction like Singapore. SMEs may also receive lower borrowing rates as compared to some non-banking financial intermediaries prevalent in the market. We understand the financial needs of a growing business and specially caters to and supports them through the platform. Additionally the SMEs on our platform are growing at an average of 20% y.o.y in terms of turnover/ revenue.

Validus holds a Capital Markets Services Licence under the Securities and Futures Act of Singapore, issued by the Monetary Authority of Singapore.

*Exclusive Offer Terms and Conditions

SMEs who are financing with Validus for the first time can enjoy 30% off disbursement fee on their first Invoice Financing, Purchase Financing or Working Capital Financing. This exclusive Offer is intended for 361 Degree Consultancy‘s customers only, and ends 30 Jun 2021. Information provided is intended as a guide, and does not constitute a loan application or an offer of finance. Loan amount and interest rates will be based on lending criteria and may vary. Any finance or loan request is subject to assessment against Validus Capital’s lending criteria, standard disclaimers and terms and conditions. Validus Capital reserves the right to update the information without prior notice.

Team 361 is an official authorised partner of Validus. Being a leading cloud integrator, we are proud to represent multiple software solutions. We provide unbiased recommendations and will only propose the most appropriate and value-for-money solutions for you, including the information on relevant grant support available.