Our fees are transparently displayed during the booking process and include the cost of payments and wire transfers. You will be able to view the total cost charged by TranSwap before confirming the booking.

However, in certain cases, your bank or your recipient’s bank may charge an additional fee to send and/or receive money. These charges will be borne by you or your recipient. You may also need to bear additional charges if the beneficiary needs to receive a NETT amount.

What is TranSwap?

TranSwap is a cross-border payment platform for businesses and everyday people who seek to make payments overseas while reducing FX costs and complexity. We empower global business growth by simplifying global payments and collections. Through our proprietary online transaction portal and a wide network of FX Partners, our users can expect to fulfil global transactions easily and at the lowest cost possible.

TranSwap is fully regulated and licensed in Singapore, Hong Kong and Indonesia. We facilitate FX payments in more than 180 countries.

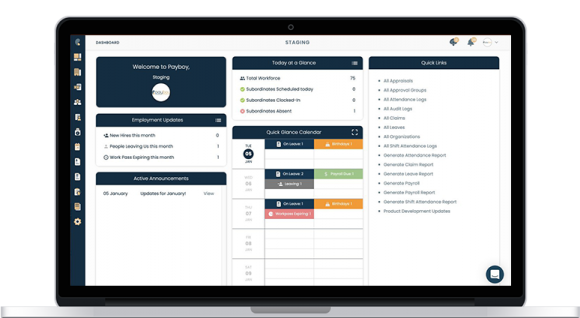

Revolutionary Clean & Minimalistic Design

Manage the chaos of Payroll & HR within one integrated platform. Thoughtfully designed to meet your every need.

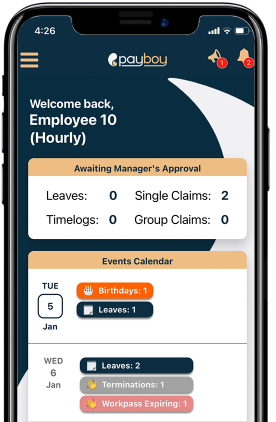

Easily accessible Payroll & HR Data

Our mobile app allows you and your employees the access to update and interact with HR related matters on the go.

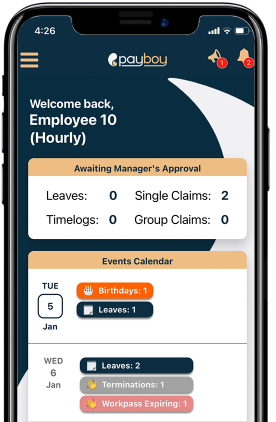

Easily accessible Payroll & HR Data

Our mobile app allows you and your employees the access to update and interact with HR related matters on the go.

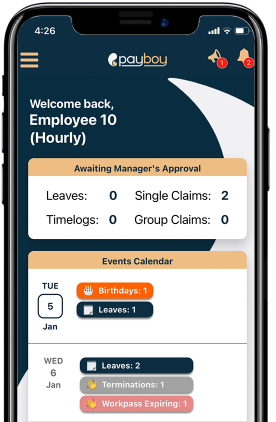

Easily accessible Payroll & HR Data

Our mobile app allows you and your employees the access to update and interact with HR related matters on the go.

Here are the steps on how to register and set up InvoiceNow in Xero through the integration partner, Storecove.

Problems that businesses face with global finance

TranSwap Solutions

Payments

Collections

Conversions

Global account

Benefits of Using TranSwap

Peace of Mind

Our team of experts will ensure your funds and data are safe and secure. We prescribe to the highest international standards.

Business Ready

Automate your international payments with our proprietary API and easily review your account whenever, wherever. Just connect us with your developer or talk to us!

International Network

Get a global network of banks and partners across 180+ countries in one platform. You can pay or collect from anyone, anywhere.

100% Transparent

No more worrying about surprise charges or hidden fees. Have full access to transaction data and track every step.

What can TranSwap offer?

Low-cost transfers

Fast transfers with end-to-end tracking

Seamless onboarding

Full support with a dedicated sales team

Transparent breakdown of rates & fees

Segregated client account for your funds

There’s a reason why Payboy has more than 500 satisfied clients & 20,000 users!

Over 2 million subscribers use Xero!

Enjoy FREE K-Reporting (Worth US$199/month) when you subscribe Xero through us!

K-Reporting is an automated financial reporting tool that provides you with customizable reports and visualization.

Why choose Team 361 as your Xero vendor?

Xero PSG Application and Claim process guides

Here are the steps on how to register and set up InvoiceNow in Xero through the integration partner, Storecove.

Training is provided to ensure that you fully utilize the powerful capabilities of Xero

Learn what we cover in our training sessions here

TranSwap: Frequently Asked Questions (FAQ)

TranSwap is regulated and licensed as a:

- Major Payment Institution (License Number PS20200415) by the Monetary Authority of Singapore (MAS);

- Money Service Operator (License Number 16-07-01882) with the Hong Kong Customs and Excise Department (HKCED); and

- Fund Transfer Operator (License Number 21/248/Sr/3) by Bank Indonesia (BI).

Our clients’ funds are permanently held within our segregated accounts in leading global banks. This means our client funds do not form any part of TranSwap’s assets.

TranSwap’s wide network of banks and partners allows you to make payments to more than 180 regions. Here are some of the more popular destinations:

- Australia

- China

- Europe

- Hong Kong

- Indonesia

- Japan

- Malaysia

- Philippines

- South Korea

- Singapore

- Thailand

- United Kingdom

- United States

- Vietnam

- Taiwan

- New Zealand

- Switzerland

- Sweden

- Poland

- Canada

Team 361 is an official authorised partner of Payboy. Being a leading cloud integrator, we are proud to represent multiple software solutions. We provide unbiased recommendations and will only propose the most appropriate and value-for-money solutions for you, including the information on relevant grant support available.