Prime Minister (PM) and Minister for Finance, Mr Lawrence Wong, has just delivered the new Budget 2025 today, with the theme “Onward Together For A Better Tomorrow”.

He highlighted key economic concerns, such as rising inflation, economic growth and the cost of living, and outlined the government’s approach to tackling these challenges.

For enterprises in particular, PM Wong emphasised the importance of investing in innovation, workforce development and digital transformation for continual growth. The government will be supporting companies through a suite of initiatives, summarised as follow:

- Corporate Income Tax Rebate

- 50% corporate income tax rebate for YA 2025

- Minimum benefit of $2,000 for businesses that employ at least ONE local employee in 2024

- Total benefits capped at $40,000

- Enhancements to Progressive Wage Credit Scheme

- Employers who raise salaries for lower-wage workers will receive higher co-funding support from the government

- Co-funding levels will be increased from 30% to 40% in 2025, and from 15% to 20% in 2026

- National Productivity Fund

- $3 billion top-up to support investment efforts

- Extension of Support Schemes for Companies

- Internationalisation programmes

- Mergers and acquisitions

- EDB to launch Global Founder Programme

- To encourage global founders to anchor and grow more new ventures in Singapore

- New Enterprise Compute Initiative

- Up to $150 million set aside for eligible companies to partner major cloud service providers

- Provides better access to AI tools and computing power, as well as expert consultancy services

- New Private Credit Growth Fund

- $1 billion set aside to provide more financing options for high-growth local companies

- Future Energy Fund

- $5 billion top-up to support clean power efforts

- New SkillsFuture Workforce Development Grant

- Bring together and simplify schemes administered by WSG and SSG

- Provide higher funding support of up to 70% for job redesign activities

- Redesigned SkillsFuture Enterprise Credit (SFEC)

- Will operate like an online wallet for immediate use to offset out-of-pocket costs for enterprise and workforce transformation

- Reimbursement is no longer required, to provide better accessibility to the credits

- All companies with at least THREE resident employees will get a fresh $10,000 in credits

- New credits will be made available in second half of 2026, and will be valid for 3 years

- Current credits, originally due to expire in June this year, will be extended till the new credits are ready

- NTUC Company Training Committee (CTC) Grant

Additional funding of $200 million to help more companies transform.

Additional funding of $200 million to help more companies transform.- Grant will be expanded to support employer-led training efforts that lead to formal certifications

- Extension of Senior Employment Credit (SEC)

- Extended by one year to end 2026

- Provide additional wage offsets for employers who hire Singaporeans aged 60 and above, with salaries less than $4,000 per month

- Qualifying age for highest SEC wage support tier will be raised from 68 years old to 69 years old

- Companies will be reimbursed up to 7% of wages that they pay to workers aged 69 and above

- Enhancements to the CPF

- CPF contribution rates for 55 to 65 year olds to be raised by 1.5% in 2026

- CPF Transition Offset to be extended for another year, to cover half of the increase in employer contributions in 2026

Interested to know how your company can benefit from the budget?

Join Our Upcoming Post-Budget Sharing!

Date: 27th March 2025

Duration: 1pm to 5pm

Venue: SingPost Centre

Auditorium, 10 Eunos Road 8, Level 5, Singapore 408600

Ticket Price: $108 (Standard Admission)

Gain expert insights and network with industry experts to ensure your company thrives in the evolving economic landscape. Stand a chance to win an Apple iPad and more!

For our valued client, you are invited to attend this event at no cost. Simply use the promo code “361money” during registration to secure your complimentary spot.

Click on the button now to register, limited seats available!

Alternatively, you can contact us at 6515 7906 or enquiry@361dc.com.

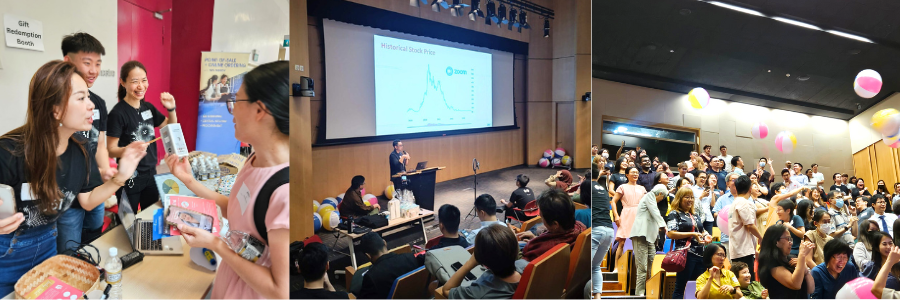

Here’s what some of the attendees said about our past post-budget event:

“The 361DC Post Budget Sharing 2024 seminar was insightful, interesting and well organised. It was one of the few seminars that had virtually no drop outs after break time. Demos and tibits provided by the speakers were very useful.”

– 姜宇Evan Jiang

“The seminar is really informative and useful to know more about the grants and budgeting process. I am really appreciative of giving the opportunity for the learning new things and hope to have more of seminar in future.”

– Htike San