A form of paid advertising that involves the promotion of websites.

SEM packages includes

Research on keywords’ price range

Search volume

Competitor ranking analysis

Keyword bidding strategy

In recent years, digital technology has been a driving force of innovation for Singapore’s workforce. The COVID-19 pandemic has further accelerated this transformation. In order to better reach target consumers who are spending more time online now, businesses are pushed towards developing attractive digital marketing plans in order to stay competitive. The good news is, the Productivity Solutions Grant is now expanded to cover such digital marketing solutions as well!

SMEs are eligible for up to 50% Productivity Solutions Grant (PSG) support for the adoption of Digital Marketing Solutions, a Pre-Approved Solution under the IMDA SMEs Go Digital programme.

SMEs can tap on the CTOaaS for 2 main types of assistance:

The practice of increasing a website’s visibility or ranking position.

SEO packages includes

A form of paid advertising that serves ads to your target audience using social media platforms with photography and videography done by a professional crew.

Social Media management packages includes

Streaming and broadcasting media in real-time on social media platforms.

Live-Streaming package includes

Process of E-Commerce website creation from consultation to development.

E-Commerce website packages includes

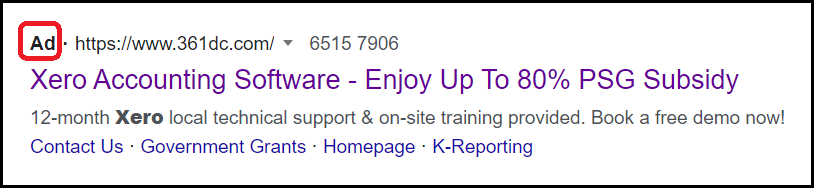

Search Engine Marketing (SEM)

A form of paid advertising that involves the promotion of websites.

SEM packages includes

Research on keywords’ price range

Search volume

Competitor ranking analysis

Keyword bidding strategy

Online Food Delivery Platforms

Data Mining & Analytics

E-Commerce Platforms

Data Mining & Analytics

These solutions range from $6,000 to $10,000.

SMEs can apply for PSG if they meet the following criteria:

Check out our blogpost where you will understand why digital marketing is beneficial to your business OR fill up the form below and we will reach out to you.

Currently the DRB is only applicable for the F&B and Retail sectors. However it may be rolled out to other new sectors if this proves to be successful in enabling digital transformation for the F&B and Retail sectors. Please complete the form below to register your interest and we will keep you posted once there are updates on DRB being made available for the other industries.

No, you do not need to submit any application. Your solutions provider will submit your UEN to IMDA and the bonus payout will be credited to your PayNow Corporate account directly. Please complete the form below to register your details in order to expedite submission.

Payouts will commence from August 2020. IMDA will take about 1 to 2 months for the processing upon submission of the UENs by the solutions providers. The payouts will be credited to your PayNow Corporate account directly and you can check your account to see if the funds have been received.

If your POS system is a qualified solution that is recognized by IMDA, then you will just need to adopt another two solutions ie. Accounting (eg. Xero or ABSS) and HR/Payroll (eg. HR Easily or Payboy), in order to qualify for Category 1 under the DRB. The bonus payout will be $2,500.

If the solutions are under the approved list, and are purchased from the approved vendors, then you are still eligible.

Unfortunately, only companies that are incorporated on or before 26th May 2020 can apply.

You can check on your SSIC eligibility here https://sgvip4.noc401.com/~dccom/drb-ssic-code/

Yes, you may appeal directly with IMDA, providing supporting evidence, eg. showing a physical store or transaction history.

Yes, you can still apply for DRB. These grants can be mutually inclusive.

Yes, you can upgrade your software and still be eligible for DRB.