What is the Auto Inclusion Scheme (AIS) ?

AIS requires employers to electronically submit the income information of their staff to IRAS. This information will then be automatically included in the tax returns and assessments for the staff by IRAS.

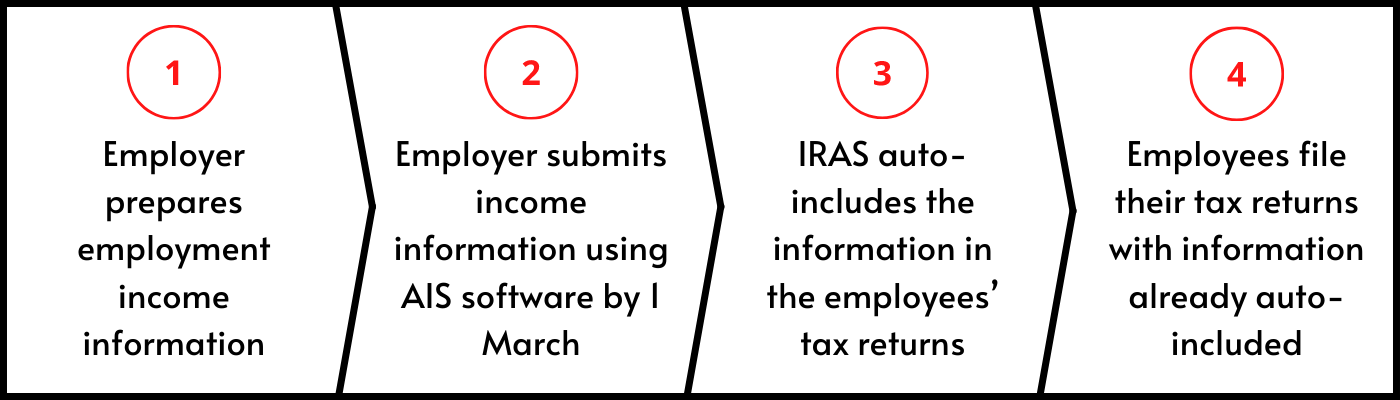

How does the scheme work?

Employers must first prepare all their employees’ income information and then submit it digitally by 1st March, through an approved HR software. The employment income information will then be automatically included by IRAS when staff file their tax returns. There will no longer be any requirement for employers to print out the hard copy of the IR8A. Everyone will get to benefit from a simplified tax filing process and the no-filing service (NFS).

Here’s a view of the entire process:

From 2022, it is compulsory to be on board AIS for employers:

- With 5 or more staff including:

- Full-time and part time resident staff

- Non-resident staff including those who are based overseas and are required to render service in Singapore during the year (exclude details of employment income where clearance has been filed)

- Company directors (including non-resident directors)

- Board members receiving Board/Committee Member Fees

- Pensioners; and

- Staff who have left the organisation but were in receipt of income within reporting year (e.g. stock option gains), or

- Who have received the “Notice to File Employment Income of Employees Electronically under the Auto-Inclusion Scheme (AIS)”

Voluntary Participation

How to get started

1. Choosing a HR software that supports AIS

There are multiple HR solutions to choose from to participate in AIS. Check out the list of available HR solutions here. For example, a solution such as HReasily could easily fulfil the following:

- Handles Supporting Form Types of IR8A, IR8S, A8A, A8B

- Complies with the full list of recommended controls (22 controls)

- Supports File Generation since YA2018

- Supports direct API Submission since YA2019

2. Funding Support for SMEs

The Singapore government has announced various initiatives to support SMEs in their digital transformation. Likely the most popular digital grant, the Productivity Solutions Grant provides up to 80% funding for SMEs who adopt new solutions to uplift their businesses. In addition, there is also the SkillsFuture Enterprise Credit that could be used to further defray up to 90% of the out-of-pocket expenses.

Ask for a Free Demo Now!